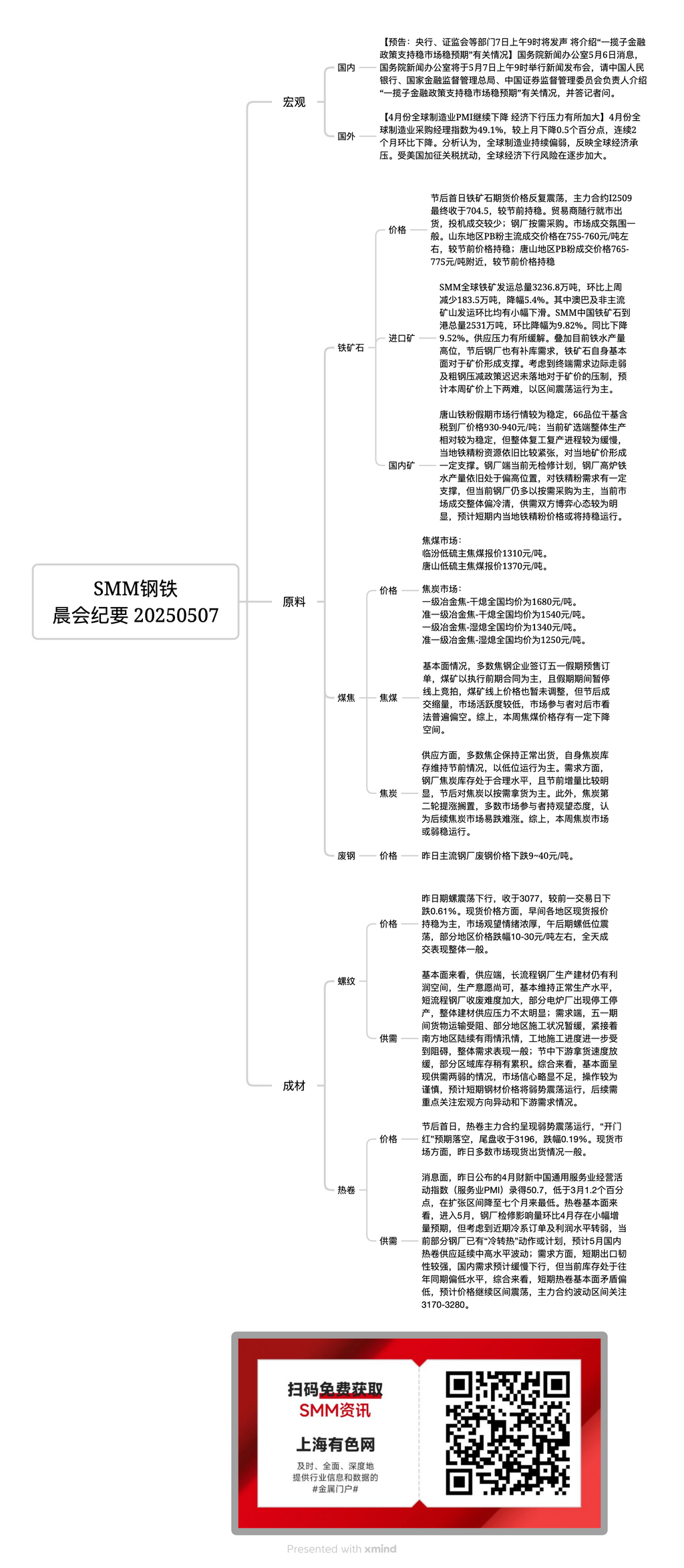

Imported Ore:

On the first day after the holiday, iron ore futures prices fluctuated repeatedly, with the most-traded contract I2509 closing at 704.5, largely stable compared to pre-holiday levels. Traders followed the market to sell, with speculative transactions being limited; steel mills purchased as needed. The market transaction atmosphere was moderate. In Shandong, the mainstream transaction prices for PB fines were around 755-760 yuan/mt, stable compared to pre-holiday levels; in Tangshan, PB fines transaction prices were near 765-775 yuan/mt, also stable compared to pre-holiday levels. SMM's global iron ore shipments totaled 32.37 million mt, down 1.835 million mt WoW, a decrease of 5.4%. Shipments from Australia, Brazil, and non-mainstream mines all saw slight declines WoW. SMM's China iron ore arrivals totaled 25.31 million mt, down 9.82% WoW and 9.52% YoY. Supply pressure has eased somewhat. Coupled with the current high pig iron production and the post-holiday restocking demand from steel mills, the fundamentals of iron ore itself support ore prices. Considering the marginal weakening of end-use demand and the delayed implementation of crude steel reduction policies, which suppress ore prices, it is expected that ore prices will face difficulties in both directions this week, with sideways movement being the main trend.

Domestic Ore:

The Tangshan iron powder market remained relatively stable during the holiday, with 66-grade dry-based tax-included delivery-to-factory prices at 930-940 yuan/mt. Currently, production at mines and beneficiation plants is relatively stable, but the overall resumption of production is slow, and local iron ore concentrate resources remain tight, providing some support to local ore prices. Steel mills currently have no maintenance plans, and blast furnace pig iron production remains at a relatively high level, providing some support for iron ore concentrate demand. However, steel mills are still mainly purchasing as needed, and the overall market transaction is sluggish, with a clear game mentality between sellers and buyers. It is expected that local iron ore concentrate prices will remain stable in the short term.

Coking Coal Market:

Low-sulphur coking coal in Linfen was quoted at 1,310 yuan/mt. Low-sulphur coking coal in Tangshan was quoted at 1,370 yuan/mt.

Fundamentally, most coking and steel companies signed pre-sale orders for the Labour Day holiday, and coal mines mainly executed previous contracts. Online auctions were suspended during the holiday, and online prices at coal mines were not adjusted. However, post-holiday transaction volumes shrank, and market activity was low, with market participants generally bearish on the future market. In summary, coking coal prices have some downside room this week.

Coke Market:

The nationwide average price for first-grade metallurgical coke - dry quenching was 1,680 yuan/mt. The nationwide average price for quasi-first-grade metallurgical coke - dry quenching was 1,540 yuan/mt. The nationwide average price for first-grade metallurgical coke - wet quenching was 1,340 yuan/mt. The nationwide average price for quasi-first-grade metallurgical coke - wet quenching was 1,250 yuan/mt.

Supply side, most coking companies maintained normal shipments, with their coke inventories remaining at pre-holiday levels, mainly operating at lows. Demand side, steel mills' coke inventories are at reasonable levels, with a noticeable increase before the holiday, and post-holiday purchases are mainly as needed. In addition, the second round of coke price increases has been shelved, and most market participants are taking a wait-and-see attitude, believing that the coke market is more likely to fall than rise. In summary, the coke market may remain in the doldrums this week.

HRC:

On the first day after the holiday, the most-traded HRC contract showed weak and fluctuating performance, with the "opening red" expectation falling short, closing at 3,196, down 0.19%. In the spot market, spot sales in most markets were moderate yesterday. On the news front, the Caixin China General Services PMI for April released yesterday was 50.7, down 1.2 percentage points from March, falling to the lowest level in seven months in the expansion territory. From a fundamental perspective, entering May, the impact of steel mill maintenance is expected to increase slightly MoM compared to April, but considering the recent weakening of cold-rolled orders and profit levels, some steel mills have already taken or planned "cold-to-hot" actions. It is expected that domestic HRC supply will continue to fluctuate at medium to high levels in May; on the demand side, short-term export resilience is strong, while domestic demand is expected to decline slowly. However, current inventories are at low levels compared to the same period in previous years. Overall, the fundamental contradiction in HRC is low in the short term, and prices are expected to continue fluctuating rangebound, with the most-traded contract's fluctuation range expected to be 3,170-3,280.

Rebar:

Yesterday, rebar futures fluctuated downward, closing at 3,077, down 0.61% from the previous trading day. In terms of spot prices, morning spot quotations in various regions were largely stable, with a strong wait-and-see sentiment in the market. In the afternoon, rebar futures fluctuated at lows, with prices in some regions falling by 10-30 yuan/mt, and the overall transaction performance for the day was moderate.

Fundamentally, on the supply side, blast furnace steel mills still have profit margins for producing building materials, and production willingness is moderate, maintaining normal production levels. Short-process steel mills face increased difficulty in scrap collection, and some electric furnace plants have stopped production. Overall, the supply pressure for building materials is not significant. On the demand side, during the Labour Day holiday, goods transportation was hindered, and construction in some areas was temporarily suspended. Subsequently, rain and flood conditions in south China further hindered construction progress, and overall demand performance was moderate. During the holiday, downstream purchasing slowed down, and inventories in some regions accumulated slightly. Overall, the fundamentals show weak supply and demand, with market confidence slightly insufficient and operations being cautious. It is expected that steel prices will fluctuate weakly in the short term, and subsequent attention should be paid to macro direction changes and downstream demand.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)